Scary Markets and Fearful Investors

In our market outlook piece early this year, we noted that the first half of 2022 had the potential to be “tumultuous and volatile.” There were multiple reasons for this view, but largely because:

- The Federal Reserve was pivoting towards actions to slow down the economy (rising interest rates)

- Inflation readings were hitting multi-decade highs

- Stock valuations were high compared to historical norms

- Geopolitical tensions were brewing

- Too many people were bullish

Now, four months into the year, it is obvious there has been a “tumultuous and volatile” period in financial markets. In many recent conversations we have noticed an increased level of fear and anxiety from investors, particularly after seeing large declines like Friday. After all, when you listen to commentary from the media, financial pundits, and research analysts, it seems nearly everyone is bearish (negative) about the future. In fact, a recent American Association of Individual Investors (AAII) article noted that according to their weekly survey, optimism among individual investors has fallen to lows not seen in nearly 30 . . . that’s right 30 years! Think about that for a minute. Thirty years? That eclipses periods like 9/11, the dot com bubble, and the ‘08-‘09 financial crisis. How does that even seem possible? It appears investors (and therefore markets) are pricing an extremely negative scenario.

So, will the future be as grim as the market is forecasting? Consider this analogy – I love to fish. There are days I look at the weather forecast, read fishing reports, and observe conditions that absolutely convince me I will have an epic day fishing. Yet, if I only catch one or two fish, I leave the lake disappointed. However, there are other days I almost don’t go because I psych myself into believing I won’t catch anything. The reality is, if I end up catching the same couple fish that day, I head home smiling because my expectations were exceeded. So, let’s explore this phenomenon. If levels of optimism are at 30-year lows and nearly everyone is expecting a negative economic outcome, what is the probability that we will be surprised by things being better than expected versus things being worse than expected? To us, there seems to be a higher probability of upside surprise rather than downside surprise.

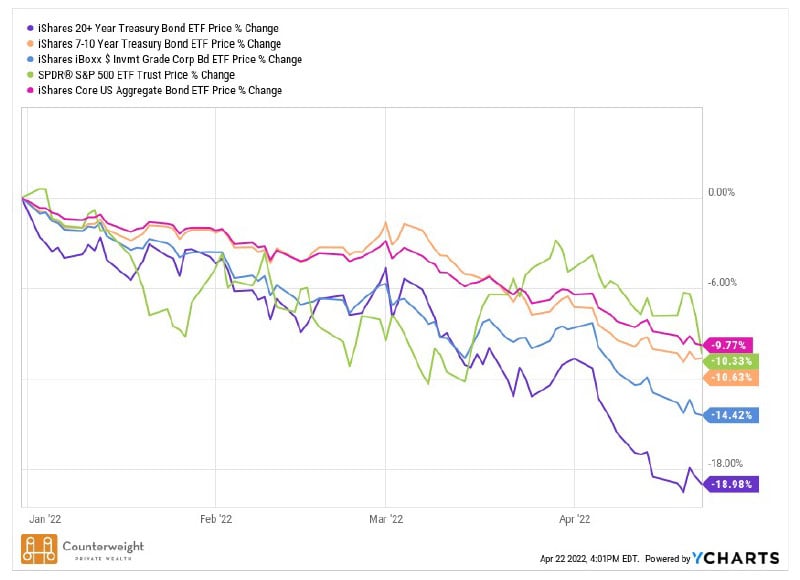

Periods of heightened fear, negativity, and pessimism are often closer to market lows than highs. While March provided a nice bounce, we believe that as we head toward the end of April and into May, we will likely retest the lows seen in February. In fact, as I write this, we appear to get closer and closer by the minute. Candidly, it is even possible that stocks hit new lows for a brief period until culminating in some type of climatic capitulation (which tends to happen at market bottoms). However, as mentioned in our January outlook piece, “TINA” is real. TINA stands for There Is No Alternative, and to us, stocks still appear to provide the best long term return potential when compared to other alternatives. In fact, many people do not realize that even after today’s selloff, the year-to-date S&P 500 return is essentially no worse than the overall bond market (see chart below) and has substantially outperformed 20+ year Treasury bonds. Why? Because in rising interest rate environments, bonds usually are not the haven that most investors assume.

All things considered; we believe it’s very possible that in the second half of the year things could get better. Inflation could decline at a faster pace than expected and the current expectations of 8-9 interest rate hikes by the Federal Reserve could likely be less than current forecasts. I realize this is a contrarian view, but there are data-driven reasons why this is a possibility. I’ll spare you the detailed commentary.

In summary, we want you to be encouraged and remember the following:

- The economic outlook may appear gloomy and the markets are volatile, but if you have a well-constructed portfolio that is allocated properly, stay the course.

- If your financial circumstances have shifted in any way (job change, sale of an asset, inheritance, family structure, etc.) it may be time to review your situation with a professional. These types of events may require adjustments to your financial plan and/or your investment portfolio.

- If you have cash on the sidelines and have been waiting to invest, this may be the opportunity you have been waiting for.

- Consistently timing the best opportunity to invest large amounts of money into the stock market is nearly impossible. We suggest investing smaller amounts in pre-determined intervals to reduce the risk of poor timing. This technique is called “dollar-cost-averaging”.

In summary, if you have clearly defined goals and you have implemented a well-constructed financial plan, be confident. Discipline and commitment are the pillars to achieving success. If you lack these things, our team is happy to have a casual conversation about whether our firm is a fit for you and your family.