Trump Accounts: Your Family's Jump Start on Ownership and Legacy

If you turned on the TV during the Super Bowl or scrolled your feed lately, you've probably heard some buzz around Trump Accounts.

In a time when headlines scream about market volatility and economic uncertainty, here's something refreshingly straightforward: a government-backed way to give your children or grandchildren a real head start toward financial independence and ownership in the American Dream.

Let’s be real. Another tax-advantaged account might soundlike more complexity. But Trump Accounts are a bit different, and if you have kids or grandkids, they are worth understanding. Done right, they may be one of the most impactful financial gifts you ever give your child or grandchild.

Who Qualifies for a Trump Account? How Do I Open One?

Any U.S. citizen child under 18 with a valid Social Security number can have a Trump Account. However, a child born between January 1, 2025, and December 31, 2028, gets a special bonus! The U.S. Government will seed their account with a $1,000 initial contribution.

Now, here's where a lot of people are getting it wrong. There's a general misconception that Trump Accounts are only for newborns in that window. That's simply not true.

Got a 3-year-old? A 10-year-old? A 15-year-old? They all qualify. Sure, they won't get the government seed, but so what? In the case of younger children, you still have years (potentially over a decade) of tax-deferred compounding ahead of them. And with the right strategy (which I'll get to in a minute), you can turn modest contributions into serious, meaningful wealth.

Opening the account is straightforward:

- Submit IRS Form 4547 with your tax return, or

- Use the portal at www.trumpaccounts.gov

The Treasury handles the setup and places the account with a custodian. You can transfer it later to Fidelity, Schwab, Vanguard, or whoever you prefer once the account is opened.

What Is a Trump Account?A Trump Account is a tax-deferred custodial account created under the Working Families Tax Cuts (part of the One Big Beautiful Bill Act). In practice,they are structured very much like a traditional IRA but designed for contributions to be made on behalf of a child under 18. The idea is simple: help kids start adulthood with assets instead of debt.

The government seeding the account with $1,000 seems to be getting all the headlines. But honestly, that's not the real story. The real power is ongoing contributions and compounding growth, and if done properly, it can have a generational impact.

How Much Can Be Contributed to a Trump Account?This is where it gets interesting:

- Private contributions: The maximum allowable contribution is $5,000 total per year. Anyone, including parents, grandparents,aunts, uncles, your college roommate, etc. is allowed to contribute as long as the aggregate amount of contributions does not exceed the $5,000 cap. This amount is indexed for inflation after 2027.

- Employer contributions: Employers can also contribute. They are capped at $2,500 per employee per year. All employer contributions are counted toward the $5,000 cap (not in addition to). As an added bonus, if your employer decides to contribute, it is not considered taxable income to the employee.

- Government contribution:The $1,000 government seed is a one-time contribution and does not count toward the $5,000 limit.

The bottom line? Max it out early if you can. The compounding potential of starting and funding a Trump account early is incredible, especially if left to grow for a long time.

How Are Trump Account Funds Invested? Who Picks the Investments?

Investments are limited to broad U.S. index funds or ETFs (such as the S&P 500) with expense ratios capped at 0.10%. This keeps costs low and focuses on reliable long-term growth rather than speculation. As custodian until age 18, you select from approved options.

I really like how rules are structured on this. Why? Because it keeps costs low and prevents people from doing potentially stupid things. No individual stocks. No crypto. No speculating on the next hot IPO. Just straightforward, low-cost, long-term growth in the greatest wealth-creating machine in history, the U.S. stock market.

It's simple. It's disciplined. If the intent is to provide an avenue for a child to get a headstart on building wealth, it does exactly that.

What Happens When a Child Turns 18?

On January 1 of the year your child turns 18, the Trump Account will convert to a Traditional IRA in their name. They take control, but the money stays in the IRA wrapper.

As with any Traditional IRA, if they pull money out for non-qualified reasons before age 59½, they will owe ordinary income tax plus a 10% penalty. That's intentional. It's designed to encourage thoughtful use, possibly a home down payment, education expenses, or (my favorite) leaving it alone to keep compounding for retirement.

What About Employer Contributions?

If you're a business owner with employees, you can contribute up to $2,500 per employee per year to their kids' Trump Accounts via a formal program. The amount is not considered taxable compensation to the employee and it is deductible to the business.

I can see it as a wonderful recruiting and retention tool, especially for employees with young families. And frankly, it's a lot more meaningful than donuts in the breakroom.

Now, if you’re like me, my strategic mind automatically wonders . . .

If I’m self-employed, can I make tax deductible “employer” contributions to a Trump Account for my kid?

I can already see the wheels turning. However, if you are a sole proprietor or single-member LLC, you cannot do this for your own kids as an “employer contribution.” There is a formal employer-employee structure the IRS requires. Your contributions would count as regular private ones which are after-tax and nondeductible.

Let’s say, however, that you are an S Corp, and therefore have W-2 employees (even if you’re the only one), you can likely set up a compliant program in which your children can benefit. Just know it must meet nondiscrimination rules and adhere to the formal program guidelines set forth by the IRS. In this instance, I highly suggest talking to your tax advisor.

The Gift Tax Issue Nobody's Talking About

There's one wrinkle here that's going to surprise a lot of people.

Unlike 529 plans, Trump Account contributions are considered “future interest” gifts. Which means they do not qualify for the $19,000 annual gift tax exclusion.

Translation?

Every contribution, whether it's $100 or $5,000, currently requires filing IRS Form 709, the federal gift tax return.

Now, before you panic there are a few things to remember. First, you almost certainly won't owe any tax. Thanks to the $15 million lifetime exemption (per person in 2026),most families are nowhere close to owing gift tax. But you do have to file the form.

Secondly, I can easily see this changing in the future. If I had to guess, future legislation will probably provide a statutory exemption to treat Trump Account contributions as “present interest,” similar to what happened a year after 529 plans were created. In fact, I foresee Congress possibly steppingin before the end of the year. I can’t imagine millions of average Americans suddenly being told they need to file Form 709 for relatively minor contributions.

Let’s all hope so, because Form 709 is a nuisance. It’s not particularly user friendly, especially for the average taxpayer and it would be an administrative and cost burden to most Americans. Particularly if you're coordinating gifts from multiple family members (parents, grandparents, aunts, uncles), it can get complicated fast.

Is this a dealbreaker? No. The long-term wealth-building potential here certainly justifies the paperwork hassle. But you need to go in with eyes open. Until Congress implements a fix (fingers crossed), proper gift tax planning is essential.

The Strategy Nobody Is Considering

As someone who’s always thinking strategically, I’ve been contemplating how Trump accounts could fit into our clients’ financial picture. Quite simply, there’s a unique opportunity it presents for those who take a strategic long-term approach. This is where things get interesting…

Can Trump Accounts Be Converted To a Roth IRA?

If you haven’t paid attention to anything else in this article, pay attention now.

This strategy will separate families who just “open an account” from families who build generational wealth.

Trump Accounts cannot be directly converted to a Roth IRA. However, once the Trump Account converts to a traditional IRA at age 18,your child (or grandchild) could certainly perform a Roth conversion. Furthermore, if they implement smart,calculated, phased Roth conversions they can essentially create an enormous tax-free legacy.

One important caveat... everything I’m about to say is based on current tax law. Candidly, tax laws could change significantly 18 years from now. But let’s have a little fun anyway.

Most 18- to 22-year-olds are in very low (or zero) tax brackets. They're in college, trade school, or very early career. They usually haven’t begun earning higher incomes (and therefore higher tax brackets).

This presents opportunity, but you must be very careful, and it will require highly nuanced family tax planning to get it right. There are numerous tripwires such as potential kiddie tax issues, child tax credit trade-offs, etc. that need to be considered. The bottom line is that for the strategy to work, there must be a high level of coordination between the parent’s tax situation and the child’s tax situation.

Having said that, here’s how it could work:

For a child born in 2026, if you max out all annual contributions to the Trump Account, the Council of Economic Advisers estimates it could grow to $303,800 by age 18.

That total value is broken down between:

- Private contributions: These create a basis that is not taxed again on conversion

- Government seed, employer contributions, and earnings: These are considered pre-tax and will be taxed on conversion

To achieve little to no tax on conversions, the child typically would need to:

- Not be claimed as a dependent on parents' return (to avoid kiddie tax on unearned income).

- Provide more than half their own support (possible with high earnings, scholarships, loans, savings, etc.)

- Have low or no other unearned income that year.

For kicks, in our example let’s suppose little Johnny has $10,000 of earned income from their part-time job working at Applebee’s.

In this scenario:

- The student gets the full single-filer standard deduction (about $16,100 in 2026).

- Even with $10,000 in part-time job earnings, they can convert up to about $6,100 per year and pay zero federal income tax using 2026 numbers (the deduction wipes out the taxable income).

- Converting another $12,000 might cause a small amount of 10% tax on part of the money, but the total tax is extremely low.

- If they converted another $38,000, they would only pay a 12% federal tax on that amount, still very low

Under these rules, many young adults should be able to move significant balances into a Roth with little cost. The money then grows tax-free for the rest of their life.

Important note: Most college students are still claimed as dependents by their parents. If that is the case, the Roth conversion opportunity becomes very limited:

- The student gets a smaller standard deduction (about $10,450 with $10,000 earnings).

- The "kiddie tax" applies to unearned income (like Roth conversions) above $2,700 per year.

- Conversions larger than about $2,000–$2,700 per year get taxed at the parents' higher tax rate (often 22% to 37%).

As you can see, as a dependent, favorable Roth conversions are limited to a small amount each year. Parents would also lose education tax credits (like the American Opportunity Credit) if they stop claiming the student. Even so, it’s a strategy worth exploring, and the potential long-term benefits could be staggering.

A few technical notes:

- Track basis carefully over the lifetime of the account

- Watch for pro-rata rules if your child has other IRAs

- Be aware of potential kiddie tax if they're still a dependent

The right choice depends on your family's exact numbers such as how much support parents provide, the size of the account, and tax brackets. You can now see why it takes careful and strategic tax planning for this to be effective. When the time comes, we will be modeling all these scenarios for our clients to maximize the leverage these accounts can create.

This is how you create generational wealth.

This is exactly the kind of sophisticated planning we do at Counterweight.

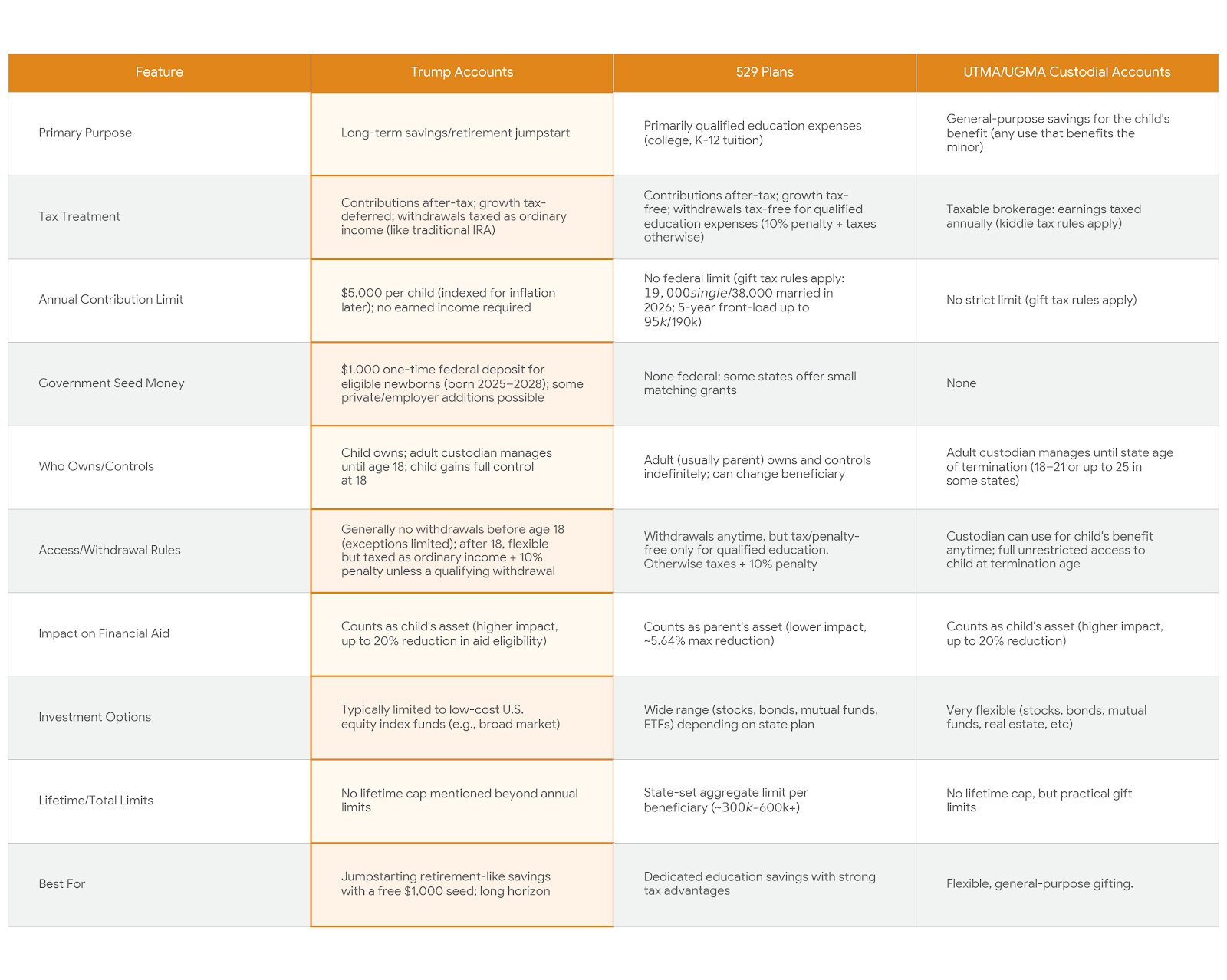

How Do Trump Accounts Compare with 529s and UTMA / UGMA Accounts?

Great question. Here's a quick comparison:

Bottom line? 529s are great for education, UTMA/UGMAs offer flexibility but lack tax advantages, Trump Accounts excel at long-term wealth building with what I believe to be potentially massive Roth conversion upside. They each have their place. Different tools for different purposes.

Should I Open a Trump Account for My Child?

Straightup... or as my kids would say “No cap” 🙄... if the government is giving your child free money, take it. All children who qualify for the $1,000 seed money should, without exception, open a Trump account.

Furthermore, I believe any child under 14-16 can also benefit from having a Trump account. It’s essentially equivalent to you making IRA contributions in their name (which they can’t do themselves if they do not have earned income).

There’s also an emerging trend of billionaires making large grants toward children with open Trump accounts. Most notably, Michael and Susan Dell made a massive $6.25 billion commitment to seed Trump Accounts with an additional $250 for about 25 million eligible US children under age 10. Other notable billionaires and philanthropists are following suit. Therefore, it’s possible your child may receive additional gifted funds.

How Much Could a Trump Account Be Worth?

Here’s some quick math. Let’s suppose you opened the account and the only funding was the $1,000 seed from the government. That alone may grow to maybe $5k–$6k by age 18.

But if contributions were maxed out every year? We're talking about possibly $200k–$300k by age 18.

Left to compound another 10 years? It could be $750,000 by age 28.

Now for the real mind blower. I had to check my math 5 times because I was blown away.

Suppose an 18-year-old ends up with $250k in their Trump account and was able to strategically convert the entire balance to a Roth over the next 5-year period. Let’s assume that leaves them (after paying taxes) $215,000 at age 23.

If left untouched, and able to compound from age 23 until age 65 at a 10% average rate of return, they would have over $11.7 million... completely tax free!

This isn't about giving your kid or grandkid a handout. It's about giving them ownership. Real, meaningful ownership in their own financial future. It's about starting them off with a foundation so they can build something even greater.

It’s about creating a legacy.

That's stewardship. And frankly, that's the kind of intentional, purposeful planning we're all about at Counterweight.

What Should You Do?

If you're a successful, late-career individual approaching retirement, selling a business, or navigating a major transition and you want to see how Trump Accounts fit into your broader family wealth strategy, let's talk.

As a fee-only fiduciary, we don't sell products. We don't earn commissions. We just help families make smart, intentional decisions that align with their values and goals.

Visit www.counterweightpw.com or reach out directly.